Tools like Meta’s Advantage+ Shopping (ASC) have convinced a lot of people that advertising on Facebook and Instagram is easier than ever.

But machine-powered and AI-driven solutions like these haven’t replaced media buyers – they’ve just evolved the role and responsibilities of this job function.

While Advantage+ Shopping has allowed our clients to see better results, it’s also created more questions for us to answer on how to get the most out of the tool.

While media buyers might be spending less time tinkering in campaigns, they are spending more time analyzing data and coming up with larger strategic questions to improve performance.

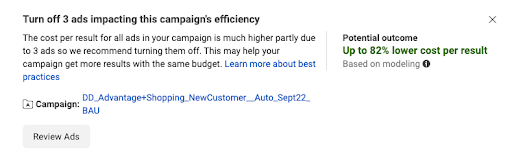

For example, in the below image you’ll see Facebook is recommending we shut off 3 ads in our ASC campaign to drive 82% better cost efficiency.

However, we’ve also been told we can automatically test up to 150 creatives and this tool will dynamically deliver the highest performing ads via automation.Here are 11 tests worth exploring based on our initial observations around ASC’s capabilities so far and questions we still don’t know the answer to:

FREE GUIDE

Digital Marketing Attribution and Measurement Roadmap

We layout a roadmap of all the measurement and attribution tools direct response advertisers should use to better understand their media’s impact.

1. Creative Differentiation

a. Observation: Facebook sometimes tends to overwhelmingly deliver ads to a couple of ads, even in ASC campaigns which means you’re less likely to see differentiated ads reach their intended audience if they aren’t explicitly given delivery. For example, selling a granola bar as an afternoon snack might be more compelling than as a morning breakfast so all the delivery would go to the afternoon snack ad. Instead, it might be better to run two ASC campaigns: one for the morning concept and one for the afternoon concept.

b. Question: Does having multiple creatives in an ASC campaign that are visually/conceptually different from each other perform better than having multiple similar creatives?

c. Test Structure:

- Cell A: Have one ASC campaign with all ads included. (i.e. put all the granola ads in one campaign)

- Cell B: Have 2+ ASC campaigns where each campaign is segmented by creative differentiation. (i.e. separate the granola ads into separate ASC campaigns)

2. Creative by audience type

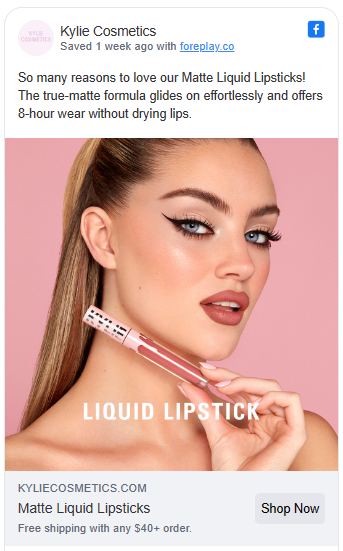

a. Observation: Featuring different demographics in creative can lead to different people taking action on your ads. People want to see themselves represented. For example, featuring different skintones in a cosmetics ad will attract different races and ethnicities to become customers. Instead of grouping all demographics together into one campaign, we can drive more incremental sales amongst different audiences by separating out the creative by the intended audience.

b. Question: Does having creative that targets different audiences perform better in one ASC or should they be separated out into different campaigns?

c. Test Structure

- Cell A: Have one ASC campaign with all ads included. (i.e. put all the cosmetics ads in one campaign)

- Cell B: Have 2+ ASC campaigns where each campaign is segmented by intended audience the creative is meant to speak to. (i.e. separate the cosmetics ads into separate ASC campaigns based on the demographics of the model)

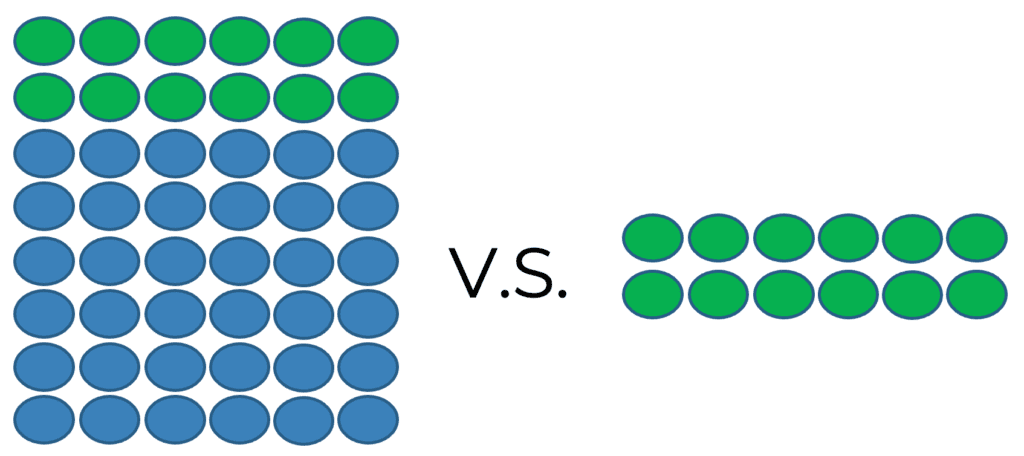

3. Ideal Number of Creatives

a. Observation: Facebook’s UI is still recommending pausing ads in ASC, despite the ability to test up to 150 creatives simultaneously.

b. Question: Should you upload 150 ads into ASC off the bat or focus only on a more limited number of top creatives?

c. Test Structure:

- Cell A: Launch one ASC campaign with all of your available ads, regardless of prior performance. (Ideally, this should be at least 2X the number of creative in Cell A)

- Cell B: Launch one ASC campaign with only your top 5 to 10 ads based on historical performance.

4. Creative Rotation

a. Observation: Creative fatigue can set in if the same ad creatives are shown to users for an extended period. However, constantly updating creatives can be time-consuming and may not always lead to improved results.

b. Question: Should you rotate through creative in ASC and how often? Or should you just set it and forget it?

c. Test Structure:

- Cell A: Keep the same set of creatives in an ASC campaign and let the algorithm optimize without manual intervention.

- Cell B: Rotate creatives in the ASC campaign at regular intervals (e.g., every two weeks) to keep the content fresh.

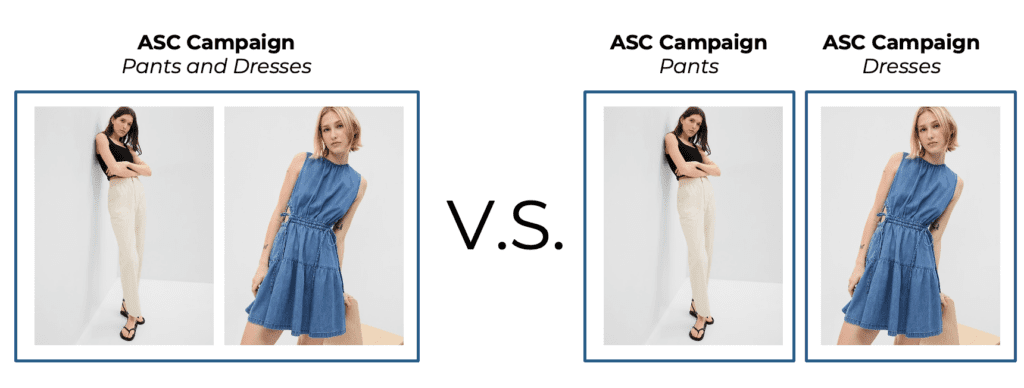

5. Product Lines

a. Observation: Different product lines may appeal to different audiences or have varying levels of popularity.

b. Question: Should different products be put into the same ASC campaign or is it better to separate them out?

c. Test Structure:

- Cell A: Include all product lines in a single ASC campaign.

- Cell B: Create separate ASC campaigns for each product line.

6. Price Points

a. Observation: Products at different price points may appeal to different customer segments or have varying levels of conversion potential.

b. Question: Should products at different price points be put into the same ASC campaign or is it better to separate them out?

c. Test Structure:

- Cell A: Include products at various price points in a single ASC campaign.

- Cell B: Create separate ASC campaigns for products at different price points.

7. Impact of existing customer caps:

a. Observation: Targeting existing customers may result in a higher likelihood of conversion, but it can also limit the potential for reaching new customers.

b. Question: Should your ASC campaign target existing customers and if so, what’s the ideal cap to drive the greatest incrementality?

c. Test Structure:

- Cell A: Target both new and existing customers in the ASC campaign, with no cap on existing customer reach.

- Cell B: Target both new and existing customers in the ASC campaign, but set a cap on existing customer reach.

- Cell C: Target only new customers in the ASC campaign.

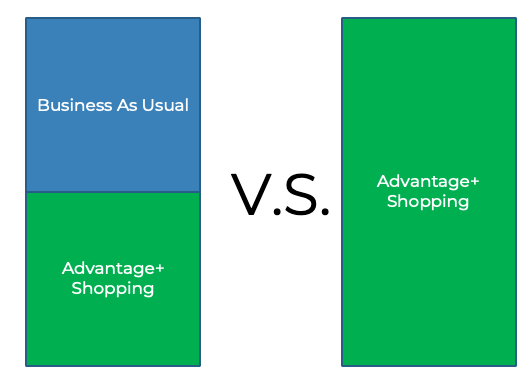

8. ASC + BAU vs ASC alone:

a. Observation: It’s unclear whether using ASC in conjunction with Business As Usual (BAU) campaigns can provide better results than ASC campaigns on their own.

b. Question: Can ASC drive the same results alone that BAU + ASC can? If you need ASC + BAU, what is the ideal mix of budget?

c. Test Structure:

- Cell A: Allocate 100% of the budget to ASC campaigns.

- Cell B: Split the budget between ASC and BAU campaigns in various ratios (e.g., 50:50, 70:30, 30:70) to determine the optimal budget allocation.

9. ASC at Scale

a. Observation: Increasing the budget on ASC may have a direct impact on its performance.

b. Question: How does increasing the budget on ASC impact its performance?

c. Test Structure:

- Cell A: Launch an ASC campaign with a small budget.

- Cell B: Launch an ASC campaign with a medium budget.

- Cell C: Launch an ASC campaign with a large budget.

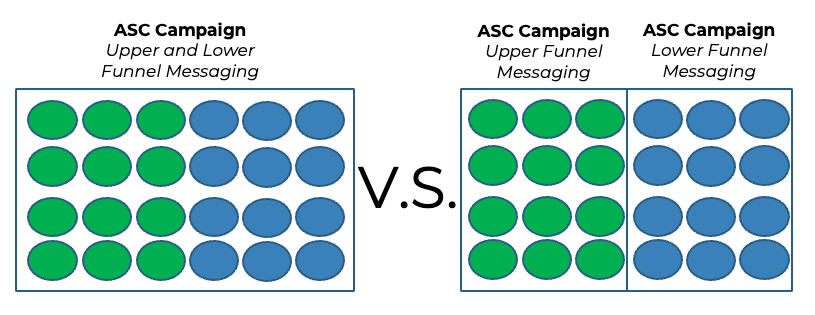

10. Messaging and Creative for Different Funnel Stages:

a. Observation: Different messaging and creative approaches may resonate with various audience segments at different stages of the sales funnel. Prospecting creatives typically focus on raising awareness and generating interest, while retargeting creatives aim to re-engage users and drive conversions.

b. Question: How do creatives tailored to different funnel stages perform in an ASC campaign? Should prospecting and retargeting creatives be included in the same campaign or separated into different campaigns.

c. Test Structure:

- Cell A: Launch an ASC campaign with both prospecting and retargeting creatives included.

- Cell B: Launch separate ASC campaigns for prospecting and retargeting, each containing creatives tailored to the respective funnel stage.

11. Promos vs Evergreen content:

a. Observation: Promotional content might drive short-term engagement, while evergreen content may provide long-term value.

b. Question: Which type of content performs better in an ASC campaign – promotional or evergreen?

c. Test Structure:

- Cell A: Launch an ASC campaign focused on promotional content.

- Cell B: Launch an ASC campaign focused on evergreen content.

In conclusion, while media buying isn’t dead, the role of media buyers has evolved to focus more on strategy, data analysis, and creative testing. Tools like Meta’s Advantage+ Shopping have transformed the advertising landscape, but they haven’t made media buyers obsolete. Instead, they’ve opened up new opportunities for experimentation and optimization.

As we continue to explore the capabilities of ASC and other AI-driven advertising solutions, media buyers will remain essential in asking the right questions, designing effective tests, and interpreting the results to maximize campaign performance. By staying agile and embracing these new technologies, media buyers can evolve with the ever-changing digital advertising landscape and ensure their clients’ campaigns remain successful and cost-efficient.