This article was originally featured on MarketerHire

Time and time again, we’ve had new clients coming to us stating that they want to keep their ad costs as low as possible. You see this all over industry blogs, too; the focus of minimizing ad costs to maximize their ROAS.

However, this approach can actually impact your profitability in a negative way.

High ROAS isn’t everything, because it doesn’t just exist in a bubble; it’s only one variable in a more complicated equation that also needs to account for often-forgotten factors like your gross margins and discount codes.

In this post, we’re going to discuss why profit is superior to ROAS, how to establish a realistic ROAS goal, and how to account for factors like discounts and incentives when assessing profitability.

How to Establish Your ROAS Goal

When you’re trying to come up with a realistic ROAS goal, it’s important to first consider your breakeven point based on your gross margin. That is, what is the ROAS target I need to hit to avoid losing money on a new customer?

To calculate gross margin, you first need to take all of your variable costs on an average order into account, including but not limited to:

- Cost of goods sold

- Shipping

- Payment processing fees

- Discounts and other incentives (often neglected, which we’ll talk more about in a minute)

From there, gross margin is calculated with the following formula:

Gross Margin = (Average Order Value – Variable Costs) / Average Order Value

After calculating your gross margin, you can calculate ROAS targets with the following formula:

ROAS = 1 / Gross Margin

Even once you have your target ROAS, however, it’s essential to remember that it isn’t the only thing you should be focused on, or even your top priority. It’s only a single metric in a larger equation.

What To Focus On Instead of Maximized ROAS or Lowest CPA

Plenty of entry-level advertisers are probably balking by now. If you aren’t prioritizing low CPAs and high ROAS, what should you be focusing on?

The answer is simple: Profit.

You can’t scale with growing profit, and we’ve seen advertisers lose money on ad campaigns that they never get back by forgetting to center profitability.

Profit will guide you to determine which campaigns are actually bringing in the right customers and that sometimes might be at the antithesis of a higher ROAS.

For example, a higher ROAS might actually be less profitable for you if you’re heavily discounting or going on sale often. You need a higher ROAS to maintain profitability when your margins are squeezed.

Why Discounts & Incentives Play a Crucial Role in ROAS & Your Breakeven Point

It’s common practice to add hefty discount codes onto ads to entice new users to convert. While this can be effective, it can also eat into your profit margins and your ROAS quickly, even if you don’t notice right away.

Discounts and incentives can be big levers that impact your breakeven point. Even if your ROAS seems to go up because more users are engaging and converting, it can undermine your profitability.

The larger the discount you give a customer, the higher your ROAS needs to be in order to breakeven. And since bigger discounts don’t always mean more high-value customers, this can backfire in a big way.

Let’s look at an example. If a client sells $100 organic pajama bottoms, they’re looking for a very specific type of customer who is willing to spend that. If they advertise offering half off your first purchase, they’ll likely see a surge of conversions, but those customers may never purchase again if $100 is out of their budget or if they just bought because it was a great deal. The brand spent a lot on ads and discounts on customers who will never convert at full value because they were deal seekers vs value seekers.

Going after cheaper customers can lead to customers who aren’t as loyal, sweeping in for the deal. Many advertisers try to lead with free samples, limited-time offers, and first-time discounts. They assume that the customer will try the product, love it, and stay on, but that just doesn’t always happen.

Deal seekers are notoriously fickle and often lack brand loyalty. They typically aren’t worth acquiring, and definitely not on a paid social platform where you’re taking on acquisition costs.

A Case Study in How Discounts Can Hinder Your ROAS

I know at this point in the article, we have a lot of readers feeling skeptical because discounts have worked for them in the past.

Let’s look at a case study from one of our clients showcasing how discounts can impact your ROAS, audience value, and profitability.

We had a client we worked with that had what we lovingly dubbed “Bed Bath & Beyond” syndrome. There were always coupons available, trying to leverage that buyer’s FOMO. As a consumer, you were expected to buy with a coupon.

We strongly believed that this discounts-for-everyone approach was limiting their ability to scale not only their ad campaigns but their entire business profitability, so we set up a split test to find out.

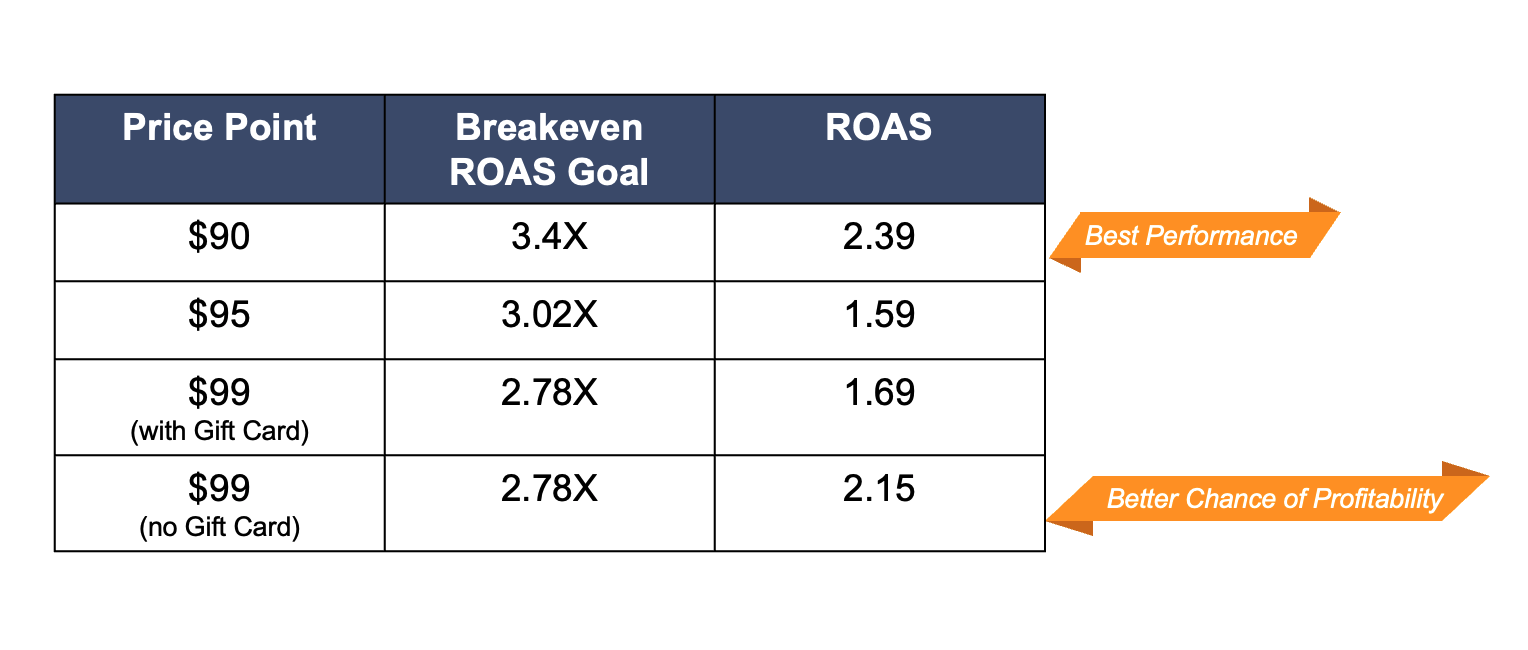

We offered four different versions of their hero product at four different price points:

– $90 (their initial offer)

– $95

– $99 with a gift card

– $99 with no gift card

According to their data, this was the correlation between price point and breakeven ROAS goal:

We ran the test at scale, and the results were surprising.

While the $90 offer was the ROAS winner, the $99 offer with no gift card was the second-best performer and had the greatest chance of profitability.

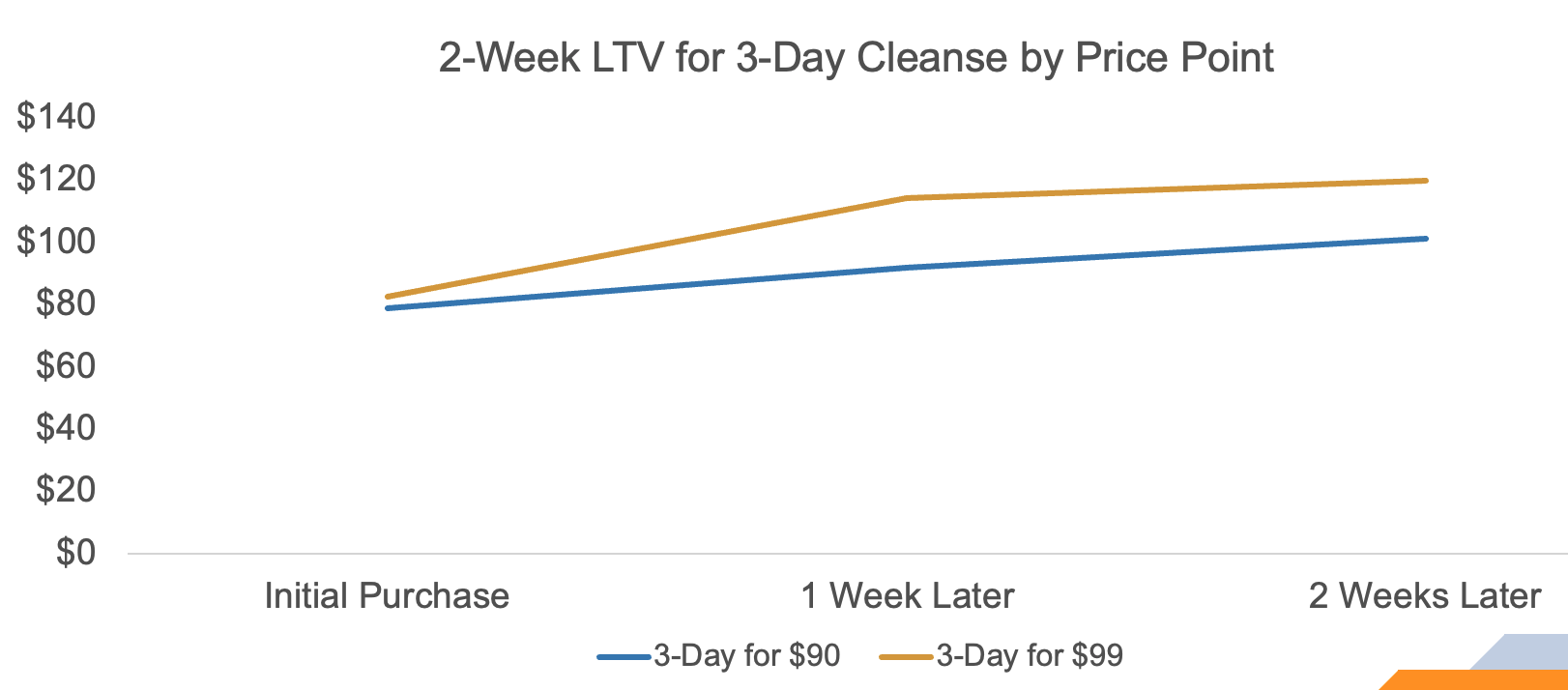

Our best margin offer (which was the worst customer) could be the most profitable if looking at ROAS alone, but we wanted to wait and see. After two weeks, we looked at the LTV on the orders.

Not only did the $99 customers spent more upfront, they also spent 20% more two weeks later.

While sales were lower compared to the $90 price point, our ROAS was good enough on a $99 price point because it could be more profitable based on the costs shared by the client.

With a 10% price increase, FB found higher quality users. CPAs & ROAS were less cost-efficient at a first glance, but LTV & profitability improved. This makes a higher CPA worth it, and it paid off in both the short- and long-term, as you can see above.

3 Non-Discount Incentives That Won’t Destroy Your Profit

We want to acknowledge that in certain instances and when executed correctly, incentives and discounts have their place and can result in more loyal customers.

The goal should be to create incentives for value seekers rather than deal seekers.

When you focus on giving people more, it’s unlikely that the customer is just deal-seeking.

As a result, it doesn’t hurt to test out non-discount incentives. In fact it can help with both profitability and improving customer loyalty.

We recommend testing the following to provide value to customers without dramatically eating into your profit margins:

– A store gift card with a purchase (creates incentive to buy again)

– A free product or product sample with a purchase (sampling more products means more reason to upgrade or spend more the next time you purchase)

– A free product upgrade with a purchase, like having a product customized, monogrammed, or engraved (can reduce return rates and build greater loyalty)

You can also try to sell complementary products as a set or bundle with a built-in discount that’s appealing but not so steep that it hurts your campaign. This can increase the average order value while giving the user a strong incentive to purchase as a win-win for everyone.

Final Thoughts

I know that this article gives you a lot of advice that may go against some of the tips you’ll find on entry-level marketing blogs that swear that low CPAs are key to scalability and that discounts mean conversions.

While low CPAs and high ROAS metrics are exciting to see, they aren’t enough on their own to guarantee a profitable, successful, scalable campaign. You need to have all the pieces in place for your campaign to drive real results at price points that are actually scalable.

To ensure that you’re setting the stage for a successful campaign, focus more on profit and LTV and don’t prioritize CPA and ROAS alone. Higher CPAs may deliver more valuable audiences, and often without extra discounts added on that would only eat into your profit further.

As always, run thorough tests to see what works for your business. We’re here to help in the meantime.

Looking for help calculating your target ROAS and maximizing profitability with paid social ad campaigns? We can help. Get in touch with us here.