Attribution can be messy. It’s difficult to know exactly what triggered a conversion, or how long someone knew about the brand before they finally decided to purchase.

While the right attribution models through analytics software can help, it’s still not bulletproof and ironclad. Someone may have first heard about your brand six months ago and considered buying ever since, but that’s far outside standard attribution windows that analytics would capture.

This is why we strongly recommend using post-purchase surveys; it can tell you what attribution analytics alone may not be able to. In this post, we’ll explain why post-purchase surveys are so useful when assessing attribution and share tips for how to implement them.

Why Surveys Are Useful for Attribution Tracking

There’s no single certain path to conversion for customers, and attribution can be exceptionally difficult to accurately track because of this.

This is true for all industries, but especially those that have longer customer journeys.

You might, for example, buy a t-shirt after seeing one ad and clicking through to checkout. Impulse buys like this are easier to align to your marketing efforts.

But are you going to do the same thing with a car, a dining room table, or even your dog’s food? These are all typically much more research- and time-intensive purchases, so probably not. You might see an initial ad and then wait for months after researching before taking the leap, and that attribution will be long-gone.

Adjusting your lookback windows when possible is always a good starting point when you want better attribution, but going beyond this with a post-purchase survey is even better.

It gives you concrete information about what users remember about their specific journey, including how they discovered your brand, how long they’ve known about your brand, and why they decided to purchase.

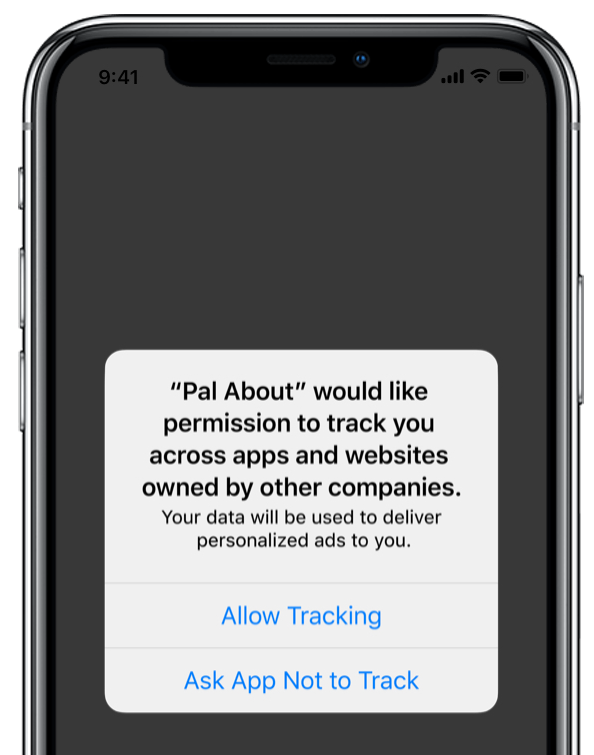

Why Surveys Will be More Important After Apple’s Privacy Updates

Apple’s privacy updates are now actively rolling out to users, automatically having tracking blocked as a default. This includes tracking pixels from Facebook’s app, meaning you can’t accurately see how your campaigns are performing. This makes attribution even more difficult to measure.

While tracking will be impaired, the information that you get from post-purchase surveys won’t be. It’s coming directly from the customer itself, and no tracking pixel can keep the data from you.

It’s a great workaround, and not only can it help you fill in complex gaps about your customer journey, it can give you more data about even the basic performance of your campaigns. You can even check your performance data against the post-purchase surveys to see how everything is lining up.

The Post-Purchase Attribution Survey Question You Need to Ask

There’s a good chance that you’ve come across attribution surveys before.

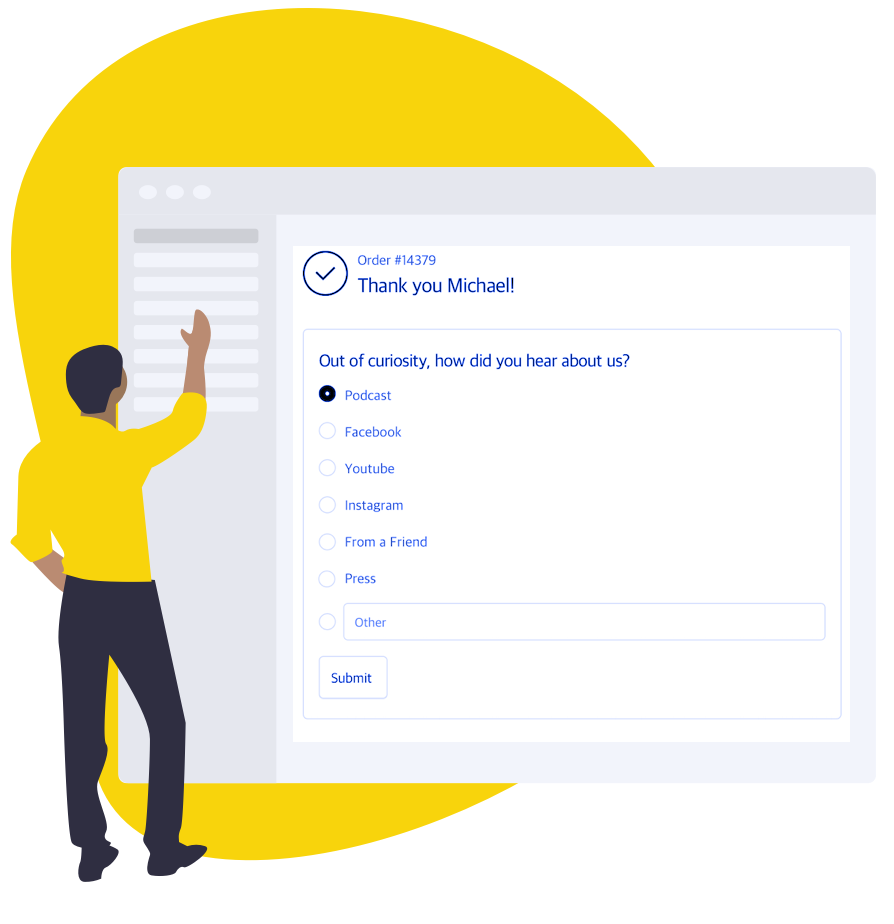

They always ask one question: How did you hear about us?

You’ll then see a list of different platforms, which may include some combination of the following:

– Google search

– Facebook Ads

– Pinterest Ads

– From a friend

– Networking event

– Social media

– Other (explain)

This is the most important question to ask, and it might even be the only one you really need to ask.

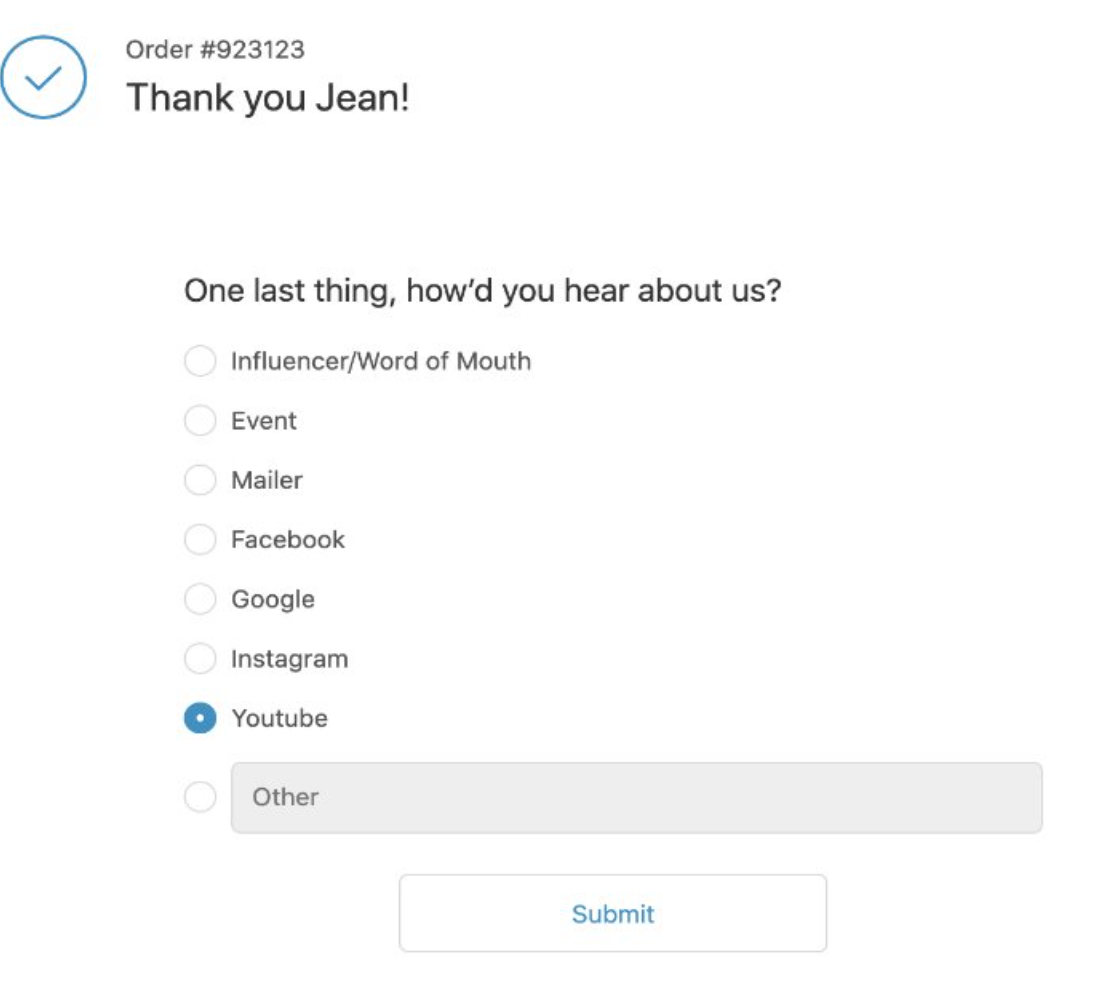

And to set it up, we recommend using either Enquire as a CRM or ProveIt’s No Attribution, which is a Shopify app and pictured above.

For best results, have the survey appear immediately following purchase on the order confirmation page. This is more effective than email distribution later, because it requires users to open and then click-through an email instead of just clicking a few buttons on an already-loaded page that they’re engaged with.

Additional Post-Purchase Attribution Survey Questions to Ask

While there’s one essential question that you need to always ask with post-purchase surveys, there are a few more that you can ask to learn more about the customer journey.

This includes:

– How long have you known about our business?

– What made you purchase with us?

– Have you purchased from us offline before? If so, where?

These can help you with basic attribution information, but even more significantly, they can act as vetting questions. This, in turn, can help you segment your audience so you can understand your customers at a more granular level and improve your advertising as a result.

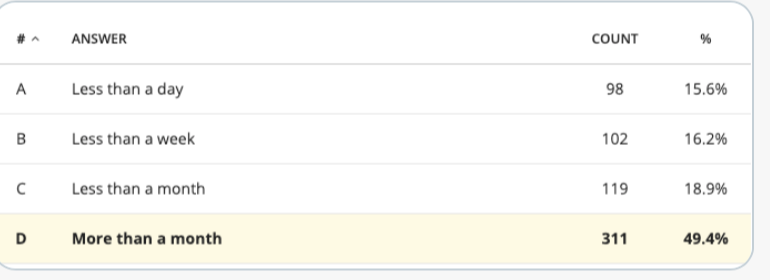

You can see an example of a survey that we had above for a client who sells luxury goods.

Because of the high price point of their products, we felt as though Facebook’s default attribution might not be a long enough window to understand the impact ads were having on overall sales.

After surveying our new customers to ask how long they knew about us before purchasing, we learned that most customers had been aware of the brand for over a month, showing the importance of multiple touch points and reengagement campaigns as well as that our reporting might be undercounting the efficacy of ads on sales outcomes.

How to Act on This Information

Understanding your business’s specific customer journey is invaluable.

Every business and industry is different, so while benchmarks are great and can be useful, they’re nothing compared to data about your customers.

Once you have this information, you can adapt your campaigns accordingly. You may realize that some platforms are more effective at driving sales than others, or at least generating memorable discovery.

You might also realize, for example, that you need more information for customers to travel through the sales funnel, that you need to extend retargeting campaigns longer, or that you need to increase ad spend in order to attract higher-quality leads.

Once the surveys come in, you can consider how you can improve your digital sales funnels and your ad campaigns accordingly.

Additionally it’s worth keeping in mind that surveys only show a primary point in time and not the whole customer journey.

For example, if a visitor typically takes a month to purchase your product after their first ad exposure, it’s highly likely it took more than one touch point to get them to buy. While they might answer “Facebook” as to how they heard about you, it’s possible a YouTube ad or an additional channel might have been an important assist in that conversion.

Surveys should be used to gut check your attribution. This solution is just another tool in your measurement arsenal not the silver bullet to understanding your marketing mix.

Final Thoughts

Not every brand will (or should) operate under the same cookie-cutter measurement when it comes to attribution. This is why there’s so much debate about which attribution models are best, and which you should choose.

Your best bet at accurate data is to build a measurement system that works for your business, based on how your customers are actually purchasing. If you don’t do this, you’re likely leaving a lot of valuable data and thus money on the table.

Want help putting the right data to use for your paid social campaigns? Get in touch with us here.