This article was originally featured on Social Media Examiner

Have you ever wondered how much a single customer is actually worth to your business? Are you looking for accessible tools to help you calculate this?

Businesses and marketers need to keep track of a number of different metrics when running their campaigns, but one that’s sometimes overlooked or can be hard to calculate is the lifetime value of an average customer.

Lifetime value (LTV) is an important metric that you should always be conscious of when you’re tracking your marketing campaigns, assessing your budget, and calculating true ROI.

In this post, we’re going to discuss what the lifetime value metric is, why it’s so important, and how you can measure and calculate it for free using Facebook Analytics.

What Is LTV?

Your customer lifetime value (LTV) tells you what the average value of a customer is worth to your business in the “lifetime” of their relationship with you. Lifetime, in this context, refers to the average amount of time your customers are retained.

Your average customer may retain for six years, for example, and purchase $2,000 during that time.

Different audience niches often have different LTVs. Some users will retain longer, for example, while others may regularly make purchases that have higher-than-average order values.

Why LTV Is Important

Your LTV is an essential metric, even if it’s one that you need to track down instead of being readily available on an ads dashboard.

Only once you understand your LTV can you accurately assess the long-term ROI of your campaigns. It’s also a crucial figure that you’ll want to take into account when determining how much you can afford to spend to acquire a customer through paid platforms, including paid social ads and even referral marketing. .

Brands who are on tight profit margins or who typically see a higher customer acquisition cost may be able to spend more to acquire individual customers once they factor LTV into the equation instead of only the profit of a first sale.

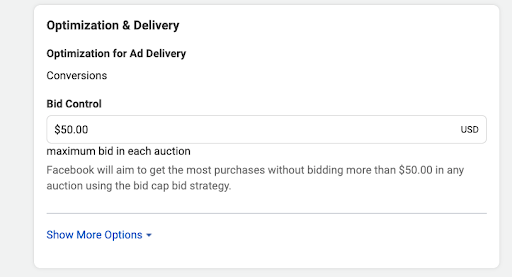

Your LTV may impact how much you’re willing to spend on specific actions when bidding on Facebook Ads.

If, for example, you pay $8 per customer on Facebook Ads and your average profit margin per order is $10, that might give you pause. It might not leave a ton of room for revenue or growth at a first glance.

However, once you factor LTV in, you may realize that your average customer will purchase 15 times on average, giving you $150 in sales for an $8 customer acquisition cost. That’s a substantially larger ROI and may have you rethinking your ads budget and any bidding minimums that you have in place.

What’s Considered a “Good” LTV?

What’s considered a “good” LTV can be subjective, so benchmarks listed online aren’t always the most reliable. Factors like industry, business age, and business model can all result in heavy fluctuations for the baseline LTV metric.

This is why it’s so important to shoot for a target LTV based on your business’s other metrics and existing performance. In order to assess whether or not your current clients have a solid LTV, you first need to know your customer acquisition cost.

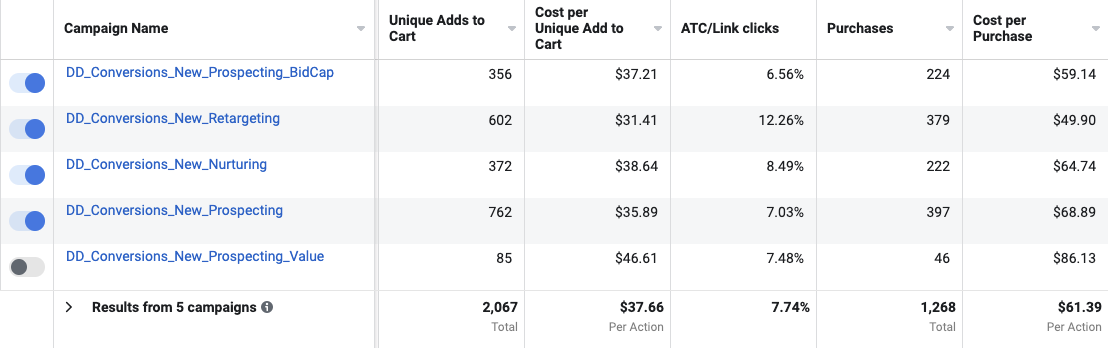

You can find your customer acquisition cost (CAC) by viewing the data reported for your ad campaigns. You can see the cost per action. For conversions, you can track “cost per unique add to cart,” and “cost per purchase.” Choose the cost for your desired end goal.

Facebook’s Ads Manager shows you the cost you paid to get users to take certain actions, like adding items to a cart or purchasing.

Ideally, want a 3:1 ratio in terms of LTV to your customer acquisition costs. In other words, you want to make at least $3 in gross profit (or have a $3 contribution margin) for every dollar you spend acquiring that customer.

If you’re making under $3 in gross profit per ad spend dollar spent, this can become expensive or unsustainable over time. It may prevent you from scaling. It may be advisable to either spend less on ads in the meantime or find a way to increase LTV.

And if you find that you’re above the 3:1 ratio, it may mean that you want to be investing more on new customer growth. This will help you continue to expand your client base, potentially reach new audiences, and grow your business.

How to Calculate LTV

To calculate LTV manually, you’ll need to complete a few basic calculations first.

Here’s what you need to do:

1. Calculate the average purchase value

This tells you the average value of each purchase in a set dollar amount. Find this by dividing the total revenue in a set time period by the number of total purchases.

Total revenue in a set time period / Number of purchases made in that same period = Average purchase value

2. Calculate the average purchase frequency rate

This tells you how often individual customer are purchasing from your business on average. Find it by dividing the number of purchases in a set time by the number of unique customers who made a purchase.

Total number of purchases in a set time / The number of unique customers who made a purchase = Average purchase frequency rate

3. Calculate customer value

Your customer value tells you how much the average customer is worth at any given point. You can find it by multiplying the average purchase value by the average purchase frequency rate.

Average purchase value x Average purchase frequency rate = Customer value

4. Calculate average customer lifespan

This tells you how long, on average, customers will actively purchase from your business. This is simply the mean of all the years that customers purchase from you, which is information you can get from your CRM or sales platform.

5. Calculate your average customer lifetime value

Here’s where you get your answer. You can calculate your LTV by multiplying your average customer value and your customer lifespan.

Average customer value x Customer lifespan = LTV

How to Measure LTV with Facebook Analytics

Calculating your customer LTV can be an involved process, requiring multiple calculations before you can arrive at a single LTV. You’ll need to conduct these calculations for every different audience segment you have if you want the most accurate results.

While there are plenty of tools that promise to track and calculate LTV, some can be expensive. Fortunately, Facebook offers an LTV tool in their native analytics which is free and accessible to all businesses.

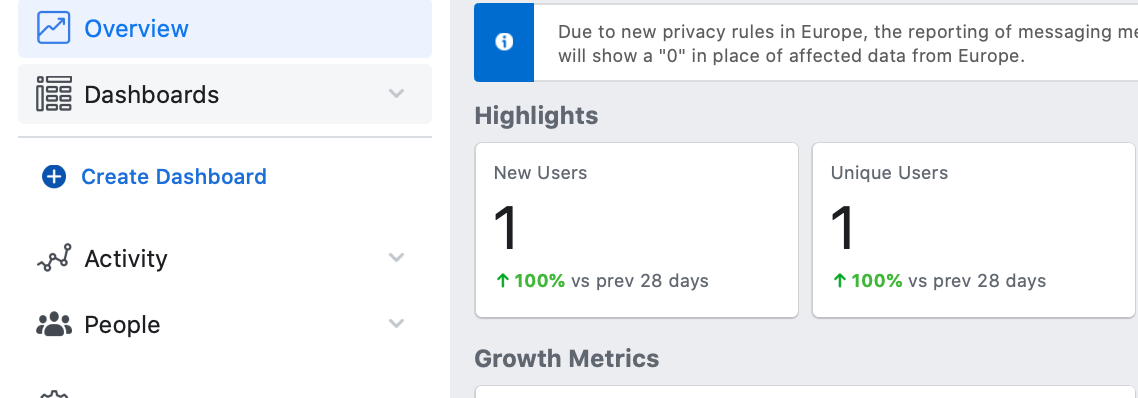

Start by accessing your Analytics here. Then, click on “Activity” in the navigation bar in the left side.

You can view Facebook’s LTV tool by finding it on your business’s Analytics page.

Under the Activity tab, you can find “Lifetime Value” all the way at the bottom. Click on it.

To access your LTV data, click on “Activity” and then on “Lifetime Value.”

This will open up your LTV dashboard.

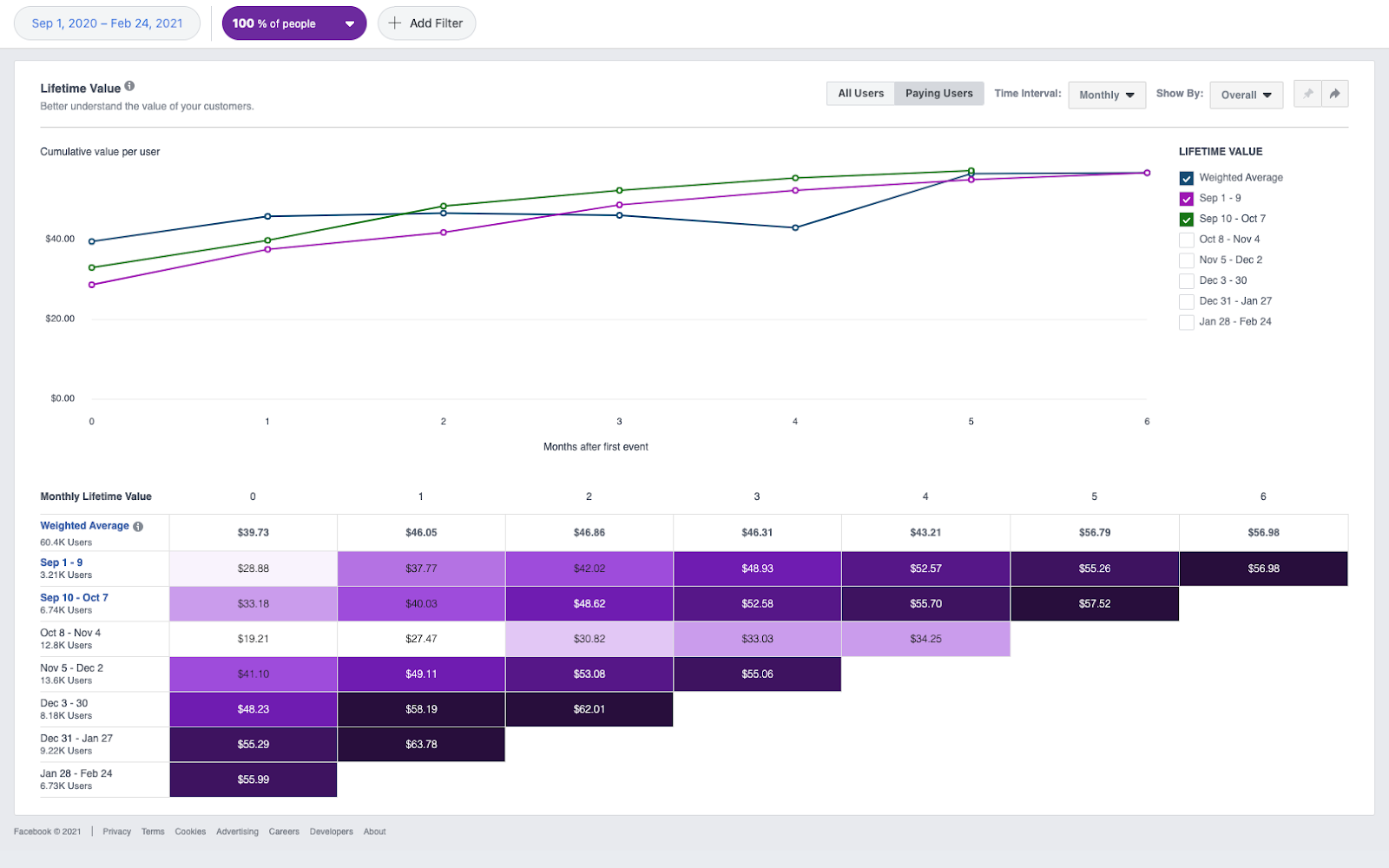

Facebook’s LTV tool shows you the lifetime value of customers during a set time period or after an initial conversion event.

Here, you can view the following:

– Your LTV for all users

– Your LTV for paying users

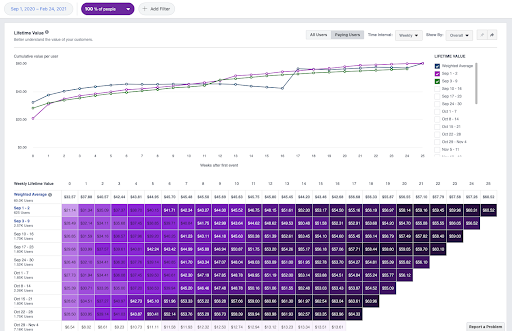

– Assess LTV over different time segments, including weekly or monthly segments after the first event

– View LTV since the original event you’re tracking, seeing its impact over time

You can view LTV over weekly or monthly periods to get a better idea of the long-term value of your customers and the campaigns that brought them to you.

Because of Facebook’s database that allows for insight into user demographics and identity, you can segment LTV by the following demographic parameters:

– Their age

– Their gender

– Their approximate location

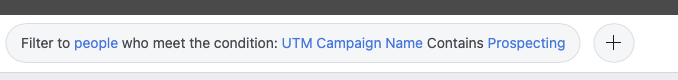

Additionally, if you want to segment people by the ads they came to your site from or by the product they purchased, you can use filters to understand how those elements might have an impact on your LTV. This may help you track offers, ads, and even products that result in higher-value clients with higher LTVs.

Use filters on Facebook’s LTV tool to segment audience data by demographics for more actionable information.

Who Can Use Facebook’s LTV Tool?

In order to use Facebook’s native LTV tool, you must meet the following criteria:

– You need to have the tracking pixel installed on your site

– You must have purchase events logged on the pixel

You must have the Facebook tracking pixel installed and purchase events set up in order to use Facebook’s LTV tool.

The tool is free, and since most businesses advertising on Facebook already have the tracking pixel installed and purchase events being tracked, this makes it an exceptionally accessible tool overall.

Are There Limitations to Facebook’s Native LTV Tool?

Overall, Facebook’s native LTV tool is a great one, especially considering that it’s free, accessible, and exceptionally easy to use.

That being said, there is a limitation to keep in mind.

Facebook Analytics data doesn’t always align perfectly with off-platform data that you may get from your CRM or from Google Analytics; many marketers experience this even with conversion tracking cross-platform.

This is because it’s based entirely on Facebook’s pixel and doesn’t take in data from other sources. Your CRM, on the other hand, may offer more accurate information overall, though it likely doesn’t come with the convenient LTV calculations ready to view.

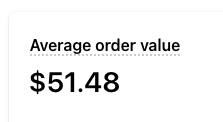

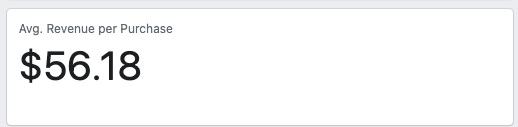

Here’s a great example. When we looked at average order value for on Shopify, it gave us $51.48. However, in Facebook Analytics the average order value was $56.18 during the same time period.

Shopify found an average order value of $51.48.

Facebook said that the same business’s AOV was $56.18 during the same time period.

Additionally, with the pending rollout of Apple’s AppTrackingTransparency update, it’s possible this data might become more limited in its ability to accurately track a customer’s lifetime value over time, as user tracking information may be significantly impaired for iOS mobile users.

We strongly recommend watching your data closely over the next few months to see how your data and campaign optimization are impacted. If there’s a significant impact, Facebook’s LTV tool may be more unreliable than it is now.

Overall, however, this is an exceptional tool that can provide valuable information that businesses can act on right away. Verify the data with your CRM to make sure everything checks out, but you can use this data to look at your campaigns and adjust your budget or bidding strategy as needed.

When used as a directional source of information as opposed to iron-clad, 100% accurate data, it is most valuable.

Other Free LTV Calculation Tools to Consider

If you want to take a more manual approach to LTV calculations than simply relying on Facebook’s data, there are several other free tools that can help you calculate your LTV quickly.

Some of these tools, however, may neglect to account for some metrics like purchase frequency or overall lifetime, and they all require more active input than Facebook’s automated tool. You’ll also need to continually assess LTV as your data changes overtime.

Here are a few good options to check out:

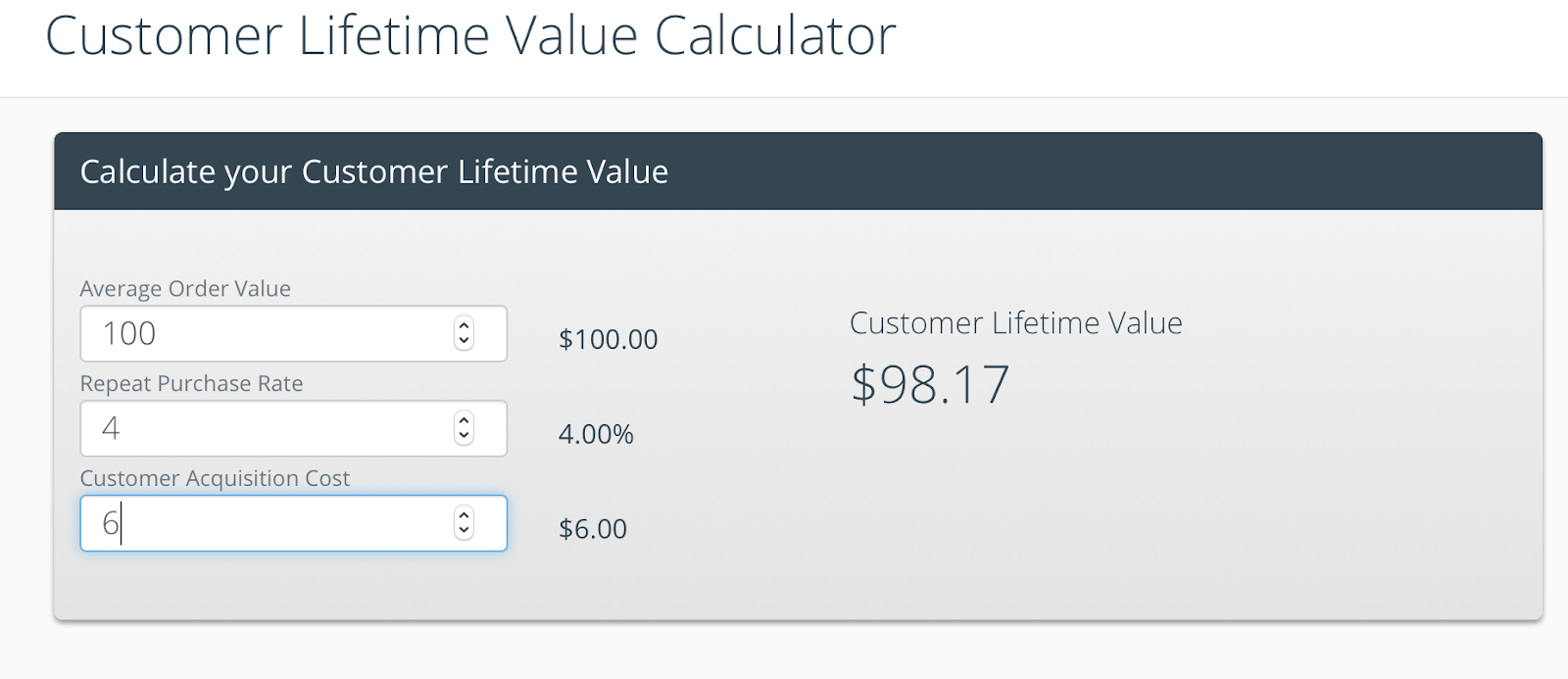

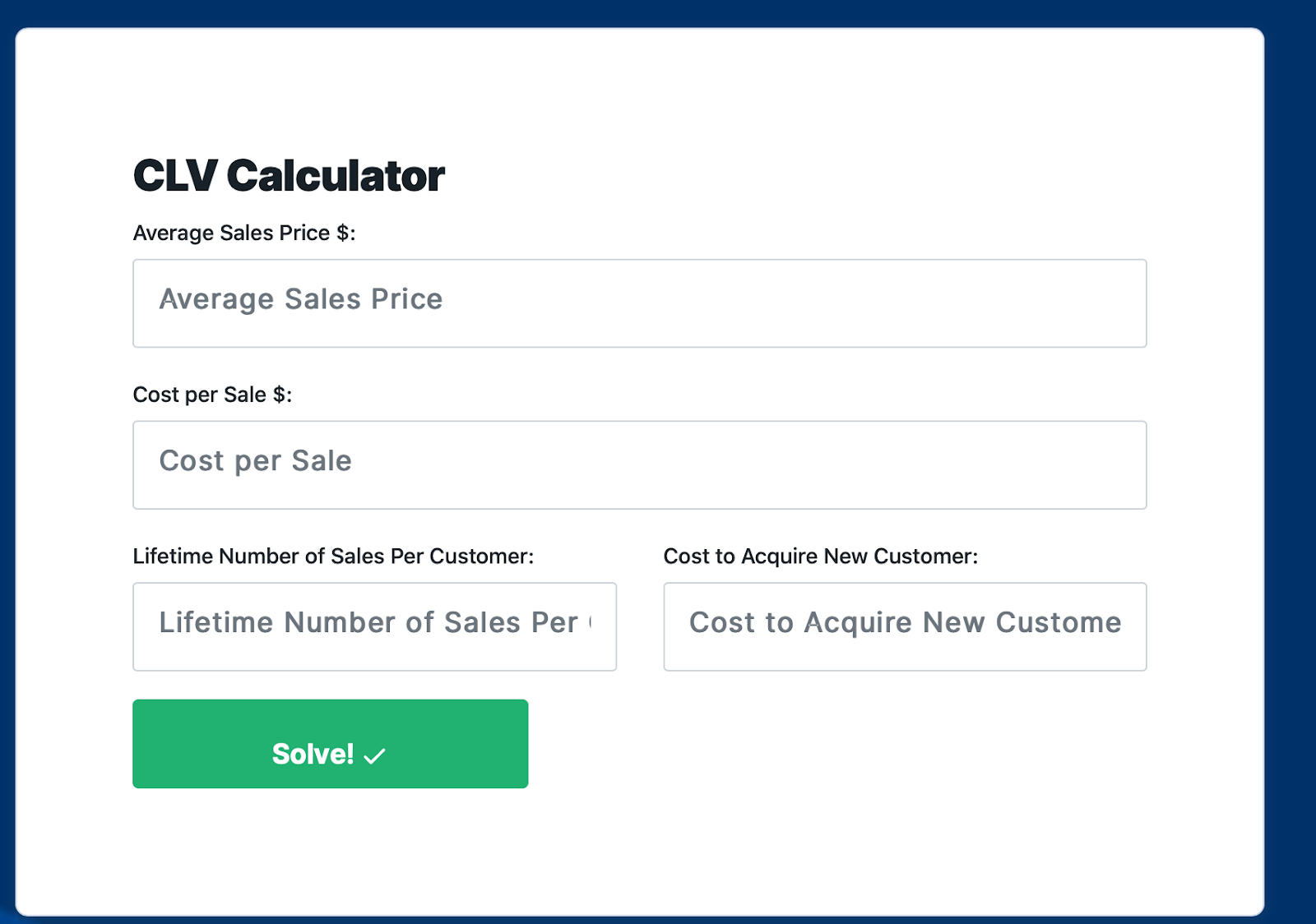

– Neatly has a free, on-page LTV calculating tool that requires you to add your average order value, purchase frequency, and customer acquisition cost

Neatly’s free LTV tool is easy to use, asking for basic information that you’re likely to have on hand.

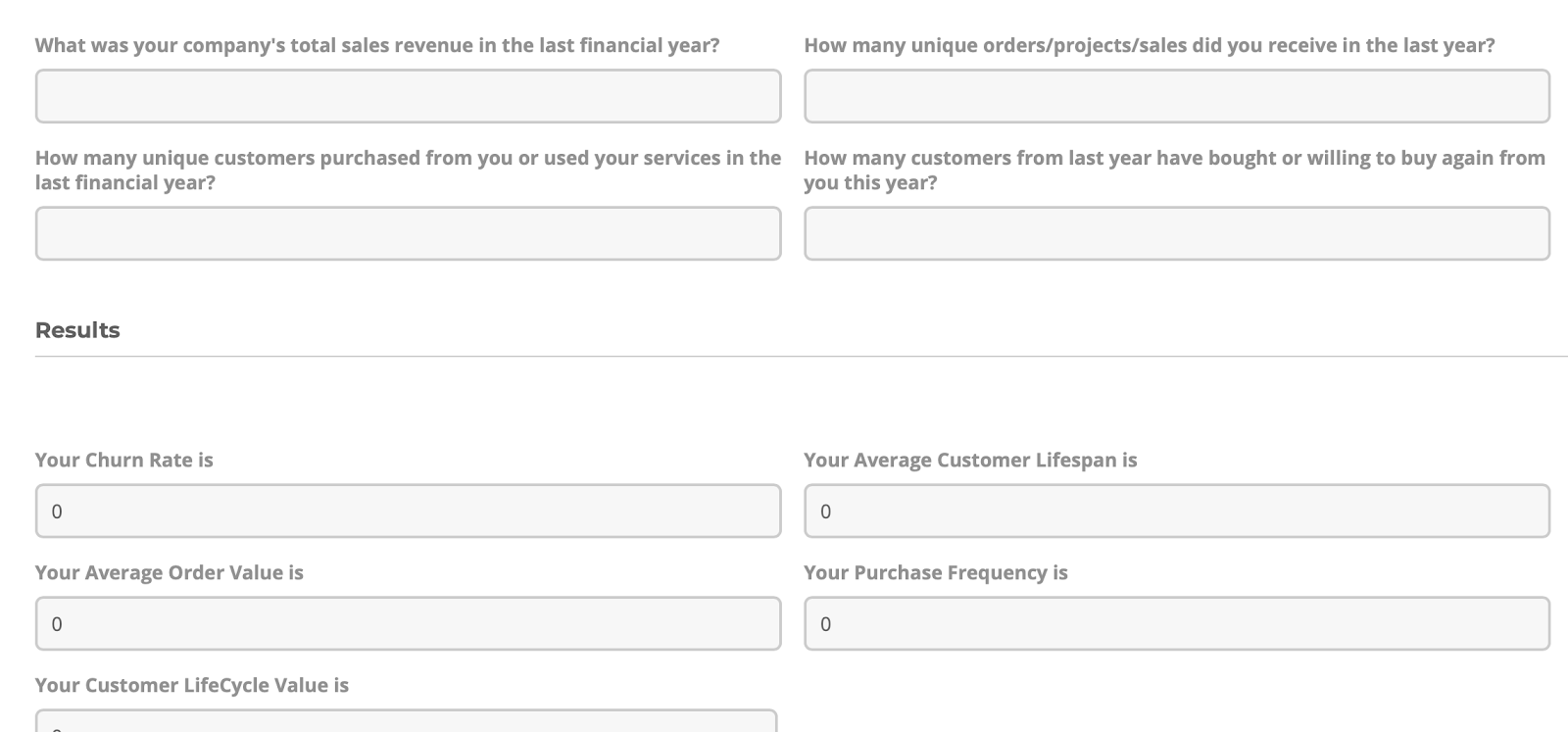

– Enterprise Monkey also offers a free tool, which is more extensive but requires an email to send you the reports

Enterprise Monkey’s tool is more sophisticated than Neatly’s, asking for more fields of information.

– WebFX has a completely-free tool that takes all crucial metrics into account

For users who want a free tool with no email required, WebFX’s LTV tool accounts for the core factors in determining LTV.

Final Thoughts

Calculating your LTV should be a central part of managing your Facebook Ad campaigns.

It can help you ensure that you’re attracting the right, high-value audiences for your businesses, while also being an important tool to accurately calculate ROI and what you can truly afford to spend on cost-per-actions.

This information is valuable even outside of Facebook Ads, as it can give you a directional look at your lifetime value for your business overall. You can then compare your LTV to industry benchmarks, or see if there’s room for improvement

Since the tool is free, there’s no downside to checking it out to see what information it can offer your business.

What do you think? Do you use Facebook’s native LTV tool for your business? Please share your thoughts and comments in the section below.

Ready to scale your paid social campaigns to new heights? Get in touch with us here.