We originally wrote about the impact of iOS 14 on paid social here.

While Facebook recently put out an article explaining Apple’s new iOS 14 policy will have a harmful impact on many small businesses, they didn’t fully explain the impact this will have for those advertisers along with why these underlying challenges will occur in 2021.

In this post, I will explain the impact advertisers are going to face due to Apple’s iOS 14 updates, why this is more than just a reporting problem and what this means for non-Facebook advertisers as well.

I’ll lastly go into what steps Facebook advertisers should take and why you shouldn’t go full panic mode quite yet.

What is Apple’s iOS 14 Update?

Apple’s iOS 14 is the latest major update for the platform, and it rolled out at the end of September.

Perhaps the most notable change iOS14 introduced was the new feature designed to give users more control over third-party data collection.

Before iOS14 (and for those who don’t have it), users need to actively dive into Facebook’s settings to turn off data collection. This isn’t something that most people know how to do, and many don’t even realize that it’s an option. Users who are dead-set against tracking, therefore, have likely gone through the trouble of disabling it, but many users haven’t.

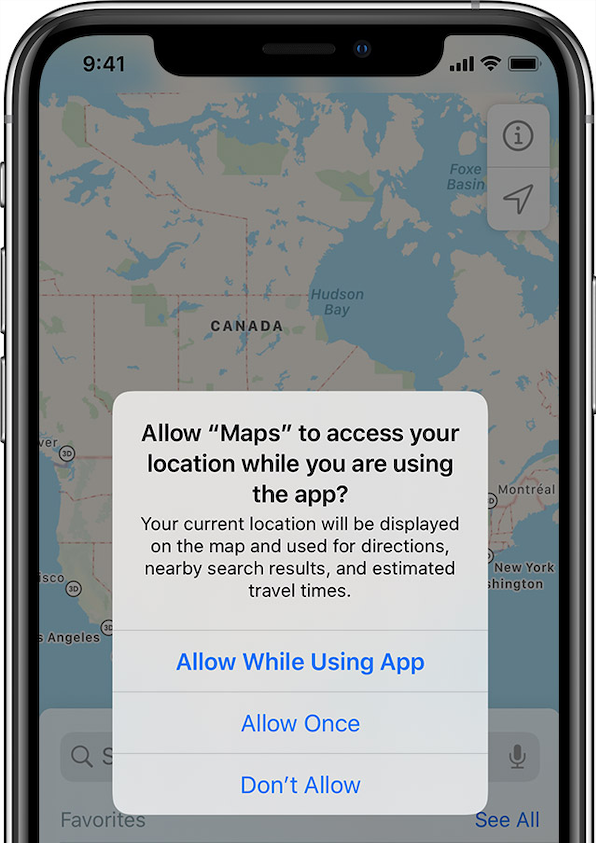

Now, though, users will proactively receive prompts from their updated apple devices that require that users give permission for data collection to happen. If no permission is given, Facebook and other publishers can’t track site and app activity through their pixels. Previously, the default option was automatic tracking; now, it’s an automatic shutdown of tracking if users take no action.

What iOS 14 Means for Paid Social Tracking

The reality is that a large number of users didn’t care enough about data collection and tracking to go into each app to disable it, but that many are unlikely to grant permissions for tracking when given a clear option. It’s easier to say no.

We’ve already seen the ramifications of a similar move Apple made when they introduced location tracking prompts in iOS 13. According to ad tech business Teemo, opt-in rates to share data with apps when they’re not in use dropped from close to 100% to often below 50%.

If Apple’s new advertising tracking prompts deliver a similar percentage of opt-outs, this will eliminate a massive amount of tracking data. If the feature is popular, Android may eventually adopt something similar for their users (though more unlikely given antitrust scrutiny).

This is directly going to impact media buying strategies and our tracking abilities.

Here are the biggest direct impacts that advertisers who rely on the pixel will see according to Facebook (app advertisers will need a separate post):

– Less conversion events to track and optimize for. Moving forward, your pixel may only optimize and track for a maximum of 8 conversion events for each domain (i.e., 8 <pixel, event> or <custom conversion> per domain). For most advertisers who are only focused on one outcome, this shouldn’t have a massive impact on your day-to-day activity. However, this could cause challenges for advertisers who operate multiple different versions of their website according to their visitors country location and/or language.

– Delayed Reporting. Real-time reporting will not be supported, and data may be delayed up to 3 days. Web conversion events will be reported based on the time the conversions occur and not the time of the associated ad impressions. This will ultimately cause challenges in understanding the purchase consideration cycle of your customers and may lead to making premature decisions in when to pull the plug on ads vs keep them running. More dollars might be wasted by advertisers to this delay in reporting.

– Estimated results. Statistical modeling may be used to account for conversions on devices that have opted out of tracking. If Facebook doesn’t have the data required to track and optimize, they’re going to aim to tweak the algorithms to help via probabilistic data. For example, in very simple terms, if 10% of people aren’t being tracked and Facebook sees 100 people converted, they might extrapolate that 110 people actually converted.

– No support for breakdowns. Delivery and action breakdowns, such as age, gender, region, and placement will not be supported. This is a big deal and goes against Facebook’s narrative of creating for growth where creative dictates targeting and not the other way around. If you can’t know who your ads are resonating with, it’s hard to make them better in the future.

– Changes to account attribution. The default for all new or active ad campaigns (other than iOS 14 app install campaigns) will be set at a 7-day click attribution window instead of a 7-day click window. Additionally, Facebook will be removing 28-day click windows entirely. While this will be a bit of a challenge initially, advertisers should start to look into their 7-day click performance only and adjust their overall ROAS or CPA goals accordingly.

– Reduced signals for pixel-based custom and lookalike audiences. If you aren’t capturing all of the relevant people in your pixel audience, there’s a chance that you’ll see smaller pixel based custom audiences to retarget to and weaker lookalike audiences than you’ve had in the past, which can impact the efficacy of your campaigns.

What iOS 14 Means for Paid Social Optimization

What Facebook doesn’t reveal in the article is that the iOS 14 ad tracking update isn’t just a reporting issue.

This is because Facebook has algorithms to optimize your campaigns by showing them to the right people. If Facebook themselves are getting less data, their optimization models may not be as efficient.

Why would this be the case?

Let’s do the math…

Of the 230M people in the US on Facebook, about 52% of those people access via iOS 14 or higher (65% if you look at all iOS versions).

As mentioned above, when Apple introduced it’s location tracking prompts in iOS 13, opt-in rates to share data with apps when they’re not in use dropped from close to 100% to often below 50%.

If people opt out of ad tracking at the same rate on Facebook because of the below forced opt-in prompt, that means Facebook is losing out on signal from about 60M people or about 26% of their US audience in non-FB apps and websites.

While Facebook still has in-app signals, losing a 1/4 of your most valuable signals (i.e. transaction data) across apps and sites, is crucial to their success delivering business outcomes for their advertisers (especially when these revenue signals are driven more on iOS than Android).

Improving your website with Facebook’s Conversions API isn’t enough as well. Facebook uses online behavioral advertising (OBA) across all the sites and apps that use their pixel and SDK to fuel your own growth. It’s worth noting OBA isn’t a Facebook specific technology. It’s industry standard.

For example, if you ever wondered why you get ads from 3 different couch companies, OBA is why. This is why you’ll see ads from 3 couch companies. Facebook knows you’re in-market. While creative plays a part to help you stand out from the other two companies vying for your attention, Facebook is doing the heavy lifting in putting the ad in front of you because of your high intent.

The strength of Facebook’s pixel and SDK is because of how many websites and apps have it set up (over 4M and 6M respectively) in combination with how many people use the Facebook family of apps.

If Snapchat’s pixel and SDK had the same level of widespread implementation across the web, their ads optimization would be lightyears stronger (for example, they could remove the required 50 purchases to unlock conversion event optimization).

Because of this potential data loss, Facebook is attempting to recreate this data via alternative means.

One of the biggest pushes to ingest this lost data is with what’s called the Facebook Conversions API. Essentially, advertisers send their transactional data directly to Facebook via a direct connection vs through a pixel on their website.

If Facebook can bypass the pixel tracking issues soon to become a challenge by getting all 4M+ websites and 6M+ apps to use the conversions API, they can retain their most important data signals – transactions.

However, this is going to take time to occur as advertisers onboard this new solution so online behavioral advertising might be weaker in the short-term when Apple rolls out their iOS updates.

Additionally, even if all advertisers do implement the Conversions API, Facebook still loses out on key intent signals that the API can’t capture because identity has to be passed through for Facebook to tie it back to the user (e.g. add to carts, time on site, etc.).

Unfortunately, this can’t be solved with small tweaks like “better creative” or “stricter attribution.”

A lack of optimization signals happening across the web and in other apps will have a dramatic impact on your ability to find success.

What about non-Facebook advertising?

Outside of Facebook, there will be a macro-impact on other platforms like Snapchat, TikTok, and Pinterest as well as traditional publishers like Buzzfeed and ad tech companies.

If this is hurting Facebook, how much will it hurt these others who don’t have the same footprint Facebook does or the identity layer Facebook can match back on?

Facebook is actually better positioned to handle tracking and optimization than most others because they have an identity layer to help match back in-app activity to off-app transactions.

So should I be panicking?

While advertisers might see these changes and be concerned on how it will impact their business, the ramifications for Facebook and the other publishers is far larger.

This is why Facebook is making a play into commerce with Shops and Instagram Checkout. If they own the transaction and keep it in-app, they can retain enough data to power ads moving forward. (Amazon’s ads ecosystem isn’t impacted by iOS 14 because everything happens in app)

The big question comes down to how much of a revenue impact this will have for Facebook. Small and medium businesses driving direct response outcomes are the lifeblood of the Facebook advertising ecosystem. If they can’t advertise as effectively, the dollars may dry up.

If those dollars can be replaced with other advertisers’ money, this isn’t a Facebook issue. It’s the small medium business advertisers’ issue.

While direct response advertising dollars could theoretically be replaced with brand dollars, advertisers who are investing in brand usually have larger dedicated marketing budgets. Based on what we saw with #StopHateForProfit, bigger advertisers leaving Facebook had little impact on Facebook’s earnings.

Instead direct response advertisers spent MORE on ads during this time, replacing the brand dollars that left the system during the month of May. This is because FB is integral to these small business’ growth.

Will Coca-Cola spend more now on Facebook because prices may be cheaper? Are the PR ramifications worth it for them and other large advertisers vs spending elsewhere? Probably not.

Like with CCPA and GDPR, it’s in the publishers best interests to figure out a solution and use all their resources to come up with a fix.

If they don’t, their business might be in more jeopardy than ours are.

Looking for new ways to drive sales or scale your business with Facebook Ads? Click here to reach out and learn more about how our services can help.