There are many debates when it comes to Facebook bidding. Should you use manual bidding or the lowest cost? What is the difference? And, most importantly, which one is better for your business?

In this post, we will discuss what manual bidding is and how it helps maximize your conversions at your CPA on unlimited spend. We will also look at what lowest cost/auto bidding does, as well as give examples of the two types of bidding.

What Is Bid Cap and How Can It Help Your Ad Strategy?

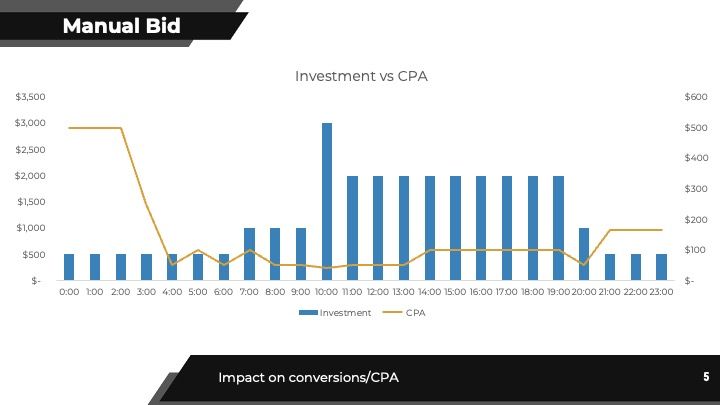

A bid cap or manual bidding is a bidding strategy that allows you to set a maximum cost-per-acquisition (CPA) threshold for your ad campaign. With this setting in place, Facebook will never bid more than the amount you specify, even if it means your ads don’t show as often. This is a great way to make sure you never go over your desired target.

When using bid cap, Facebook will automatically adjust your bids up and down to get as many conversions as possible while still staying within your set bid. This way, you’re guaranteed to get the most bang for your buck and never go over target. So, in short, bid caps help maximize your conversions at your CPA on unlimited spend.

What Is Lowest Cost and Can It Help Your Ad Strategy?

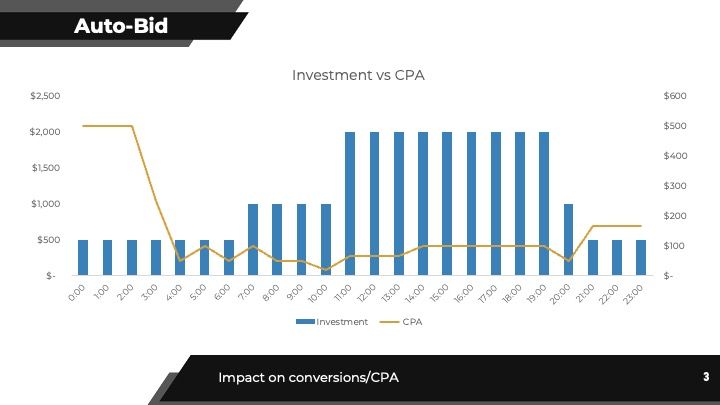

In contrast to manual bidding, lowest cost/auto-bidding is a bidding strategy that automatically sets your bids to get you as many conversions as it can while spending your budget in full and as evenly as possible throughout the day. While this may seem like the best option at first, it’s important to note that auto bidding doesn’t always get you the most conversions. Sometimes, it can lower your conversion rate due to how Facebook calculates its bids.

Example on Lowest Cost Ad Strategy

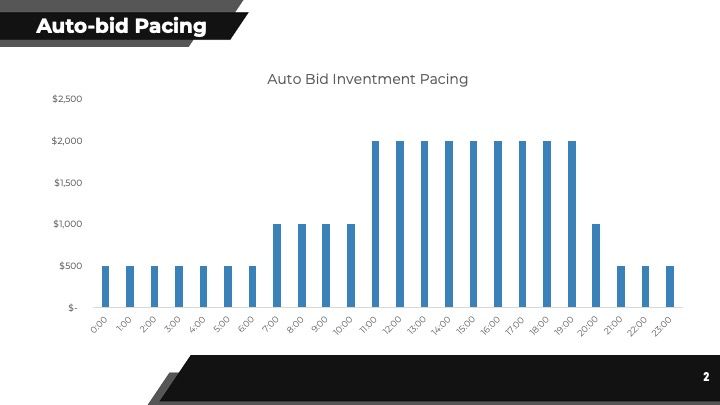

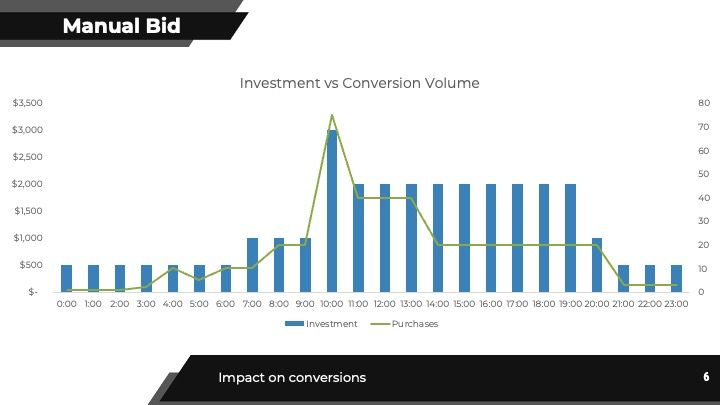

If you have a budget of $28K/day, Facebook would need to make sure that it can invest that money throughout the day, even in the later hours. This is because no one wants to see their budget used up by 8 pm. You might be skeptical still because if you graphed out your spend by hour on the lowest cost, you might see a chart like below.

For example, you might be seeing a massive number of low-cost conversions coming in at 10 am. You may want to capitalize that, but Facebook can’t continue to invest simply because they need to make sure there’s enough budget to go around for the remaining 14 hours of the day.

Example on Bid Cap Ad Strategy

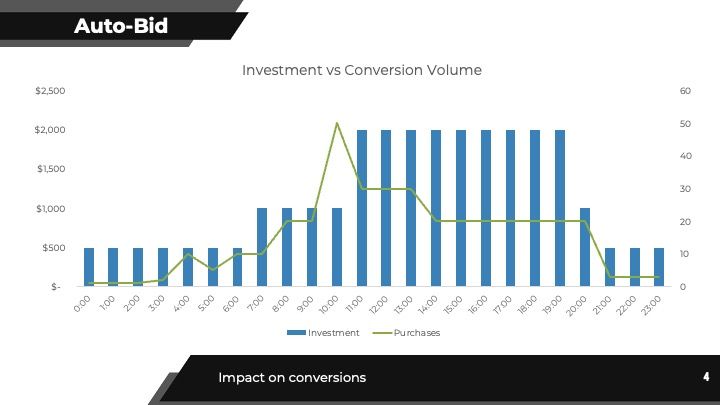

If you now decide to shift to a bid cap campaign and increase your budget to $40K/day. Facebook will still want to spend $40K/day in full. But our bid cap will put a constraint on its ability to spend all of that money. The bid cap will limit Facebook from spending if you’re not hitting your CPA target.

In the prior example, your 10 am slot was limited by your budget. Now, your non-10 slots are limited by your bids. At 9 am, for example, Facebook might want to be spending 2X more, but it can’t. Your bid is constraining delivery.

Facebook has more room to spend and still wants to spend the full budget. Unlike 9 am, it can deliver more ads within your bid now. So it’s going to spend as much as it can without going over that bid. With bids, your conversion volume and pacing might look like this for the day.

What Is an Inflated Budget?

An inflated budget is a budget that’s higher than your average daily budget. This could be because you’ve increased the amount you’re spending on Facebook ads or because you’ve switched to manual bidding with a bid cap. Whichever way you choose to do it, an inflated budget will help ensure that you’re getting the most out of your ad spend. It can be 10X more. Whatever you’re comfortable with. The idea is you should never spend your full budget on any given day.

Benefits of Running Bid Cap Campaigns with Inflated Budgets

When you run a bid cap campaign with an inflated budget, Facebook will automatically adjust your bids up and down to get as many conversions as possible while still staying within your set CPA. This way, you’re guaranteed to get the most bang for your buck and never go over budget.

Additionally, since auto bidding doesn’t always result in the most conversions, running a bid cap campaign with an inflated budget will help to maximize your conversion rate and get you more leads for the same price.

If you’re running bid cap campaigns with the same budget you’d invest on the lowest cost, you’re using them wrong.

Can You Move from a Daily to a Weekly or Even Monthly Budget Using a Bid Cap?

Bid caps help ensure that you’re getting the most out of your ad spend, so it’s advisable to use them if you can. But as much as you be on a tight budget and may want to consider moving to a weekly or monthly budget instead, it’s not quite advisable. It may make sense to use them that way, but it is hard to execute in practice. Reasons being:

- Advertisers need to use lifetime budgets to achieve weekly/monthly budgets.

- Most DR advertisers use daily budgets because they need more control over performance if things are good or go off the rails.

- Since most people don’t know how to use bid caps, they adjust their daily budgets with the lowest cost bidding based on performance instead.

- It will be harder to adjust a lifetime budget on the fly if you see good/bad performance. These adjustments have become even more important post-iOS 14.6, where Facebook reporting isn’t as reliable. You’d also likely need to constantly make new campaigns to make this work.

- Also, theoretically, a daily budget is a weekly budget because it can spend +/- 25% of the budget any given day and will average out to your daily budget, correct?

Should You Replace the Bid Cap with the Lowest Bid?

No, you shouldn’t replace the lowest bid with a bid cap. The bid cap is for scaling and should be run in conjunction with the lowest bid, not in replacement. In reality, it’s hard to find an equilibrium of bid that leads to proper CPA, especially post iOS 14.6. However, in general, using a bid cap can be more effective than relying on the lowest cost bidding alone.

Which Bid Caps Bring Success?

There’s no one perfect bid cap that will work for every advertiser. It depends on several factors, including your average order value (AOV), your ad spending, and your goals. However, in general, you should aim for a bid cap that’s around double your AOV. If you want to play it safe, start with a low bid and adjust up. The worst-case in this instance is no delivery to start.

Generally speaking, to get the maximum result, you can aim to run an auto bid campaign and use that CPA you’re getting + 20% as your initial bid.

Will Facebook Delayed Reporting Affect Your Strategy?

Facebook says it needs 3 days to get data from iOS, which can make you question how the system will know when to spend at 9 am if it doesn’t get data for 72 hours.

What you should note is that bid delivery isn’t based on conversions that have happened, but on expected outcomes. If there are a lot of cheaper users available who might convert at a certain time of day, there will be more delivery. On lowest cost, Facebook is just conserving delivery to ensure even pacing.

Prior conversion data only helps calibrate the model.

An inflated budget with a manual high bid cap removes the pacing component to help you enter more auctions.

The cost control using bid cap allows the system to better understand your willingness to pay for a particular auction transaction and therefore has more freedom to partake in auctions that meet your actual, realized CAC requirements rather than an artificial pace.

What To Do When You Use Bid Cap Campaigns but Get No Impressions

If you get no impression unless you increase the CPA to an unprofitable level, consider:

- Slowly creeping up CPA by 10% – 15% each day until you get delivery.

- Be patient.

- Using bid cap just as a way to scale beyond your lowest cost campaigns. They should be a complementary, not a replacement.

Which Strategy Is Right for You?

Manual bidding gives you more control over your ad spending, but it can be difficult to find the right balance of bids that leads to proper CPA. On the other hand, the lowest cost bidding is more automated and easier to use, but it can be less effective in terms of overall ROI.

If you’re not sure which bidding strategy to choose, or if you want to get the most out of your Facebook advertising budget, consider using a bid cap campaign. With a bid cap campaign, you set a maximum bid that you’re willing to pay for each click or conversion, and the Facebook algorithm will automatically adjust your bids to stay within that budget. Your bid is what controls the slots. This ensures that you never spend more than you want to while still giving you the chance to compete in high-value auctions.

Bid cap campaigns can be especially useful if you have a limited budget. You can get more impressions and clicks for your buck by bidding high enough to enter into more auctions. And, because you’re only paying the maximum bid if someone converts, you can often get a lower CPA than with lowest cost bidding.

If you’re thinking of using a bid cap campaign, there are a few things to keep in mind:

- First, make sure you set your bid cap high enough to enter into the auctions you want to compete in. If you set it too low, you may not get any impressions at all.

- Second, be patient. The Facebook algorithm can take a few days or even weeks to learn your new bidding strategy and start delivering results.

- Finally, keep in mind that bid cap campaigns should be used as a way to scale beyond your lowest cost campaigns. So if you’re getting good results with your current bidding strategy, don’t switch to bid caps just yet – try using them in addition to what you’re already doing.

Manual Bidding vs. Lowest Cost Bidding: The Takeaway

Both manual bidding and lowest cost bidding have their pros and cons, but bid cap campaigns can be a great way to get the most out of your Facebook advertising budget. By entering into more high-value auctions, you can get more impressions and clicks for your money. And, because you’re only paying the maximum bid if someone converts, you can often get a lower CPA than with lowest cost bidding. So if you’re thinking of using bid caps, give them a try – you may be pleasantly surprised by the results.

Not sure how to get started with bid cap campaigns? We can help. Contact us today, and one of our experts will be happy to walk you through the process. We are sure you will find it a valuable addition to your Facebook advertising strategy.